Select your age

Spring 2019

How much risk are you willing to take?

Do you see risk as a gain, a loss, an opportunity or an uncertainty? Are you willing to accept less return for more certainty? Do you feel confident about ING CDC Pensioenfonds' investment policy? The pension fund conducted an online survey to find out more about its participants’ risk appetite. This article reports on the outcome of the survey.

In order to determine its investment policy, the pension fund wants to know more about your risk appetite: what degree of uncertainty are you willing to accept? How do you feel about security and pension? Does your knowledge of pension and investments affect your risk appetite? Is your risk appetite different from that of other age groups? The survey was based on a set of individual questions, the outcome of which were studied by the pension fund.

Willing to accept risks

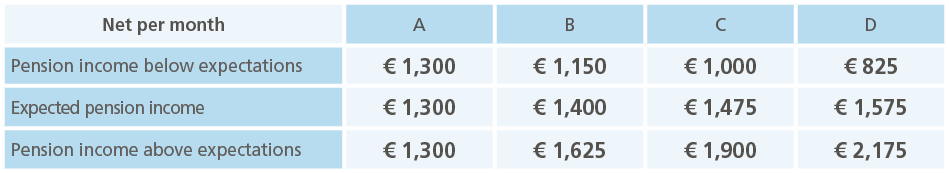

A large group of participants is willing to accept risks when it comes to pension and investments. Especially young people, men and participants in higher income brackets are willing to take more risk if it increases their chance of ultimately receiving more pension. The survey’s scenario B was generally preferred, with young people having slightly more preference for scenario C.

Risk means uncertainty

Participants tend to associate risk with uncertainty. Older people and women tend to see risk as a loss. Women feel less comfortable taking risks. They tend to avoid uncertain situations and say they play it safe more often than men do.

Pension security

Participants of all ages said they consider it most important that pensions will still be available by the time they retire. Those who study their pension and know what to expect when they retire feel more comfortable.

Understanding your pension

Some 60% of participants said they have enough knowledge of pensions. Women are a lot less positive about their knowledge of pensions than men. Men and women have more insight into their own pension situation: over 70% of participants claimed they know exactly or approximately how much pension they’ll receive when they retire.

Older employees spend more time studying their pension and are less worried about their pension. Mijnpensioenoverzicht has already been visited at least once by 80% of the participants. For the Pension Planner, this is 40%.

Knowledge of investments

To ensure they have enough capital to pay out all pension benefits plus annual indexation, pension funds invest the pension contributions. Investing is essential to ensure future pension benefits will be adequate and uprated in line with inflation. And investing without any risk is simply impossible. The survey revealed that less than half of the participants are aware that pension contributions account for 30% of their pension while return on investments account for 70%.

Confident and satisfied

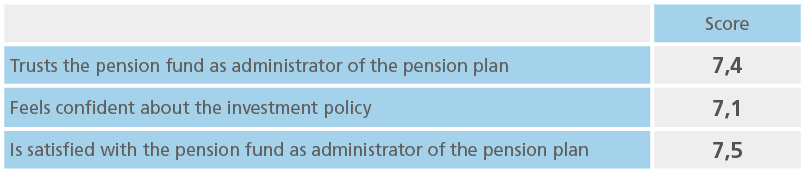

ING CDC Pensioenfonds is the administrator of your pension plan and it invests the pension contributions. The pension fund was given the following scores:

Conclusion

The outcome of the risk appetite survey was aligned with and included in the pension fund’s strategic investment policy for the next few years. Respondents in all age groups are willing to take some degree of risk. They do not prefer to have 100% certainty.