Select your age

Autumn 2020

Investing amid the coronavirus pandemic: well-balanced portfolios, acceptable risks

“We compile well balanced portfolios with good prospects for return at acceptable risk levels. It’s the only way we can meet our future pension commitments.”

When the coronavirus emerged and started to spread in February, financial markets all over the world plummeted and interest rates dropped to levels that were even lower than they already were. Since then, markets have regained much of their lost ground. How has this affected the pension fund's investments and, consequently, your pension? Read more in this article.

To ensure that there will be enough capital to pay out your future pension benefits and allow for annual indexation, ING CDC Pensioenfonds invests the pension contributions you and your employer pay into the pension fund. What you should know about this:

- Pension funds focus on long term interest rates because the average length of their pension commitments is long term as well. For ING CDC Pensioenfonds, the 30-year interest rate is most relevant.

- When stock market prices decline, the value of the pension fund's investments decreases as well.

- When interest rates go down, the pension fund's pension commitments grow.

- In other words, declining share prices and/or interest rates mean the pension fund's funding ratio declines.

Loss and recovery

Concerns over the impact of the virus on the economy led to widespread unrest on the financial markets and caused a rapid decline in market value in late February/early March. In some cases, losses amounted to more than 30% for stock exchange indices such as the S&P500, the Euro Stoxx 50 and the Dutch AEX. At the beginning of September, some markets reached the highest positions ever and move since then around this position. There have been spikes of over 50% since March. Particularly technology companies have shown sharp price rises.

Driven by support packages

Governments and central banks responded quickly with robust fiscal and monetary support packages, which have boosted financial markets and possibly the economy as well, fueling hopes for a speedy recovery.

Interest rate developments

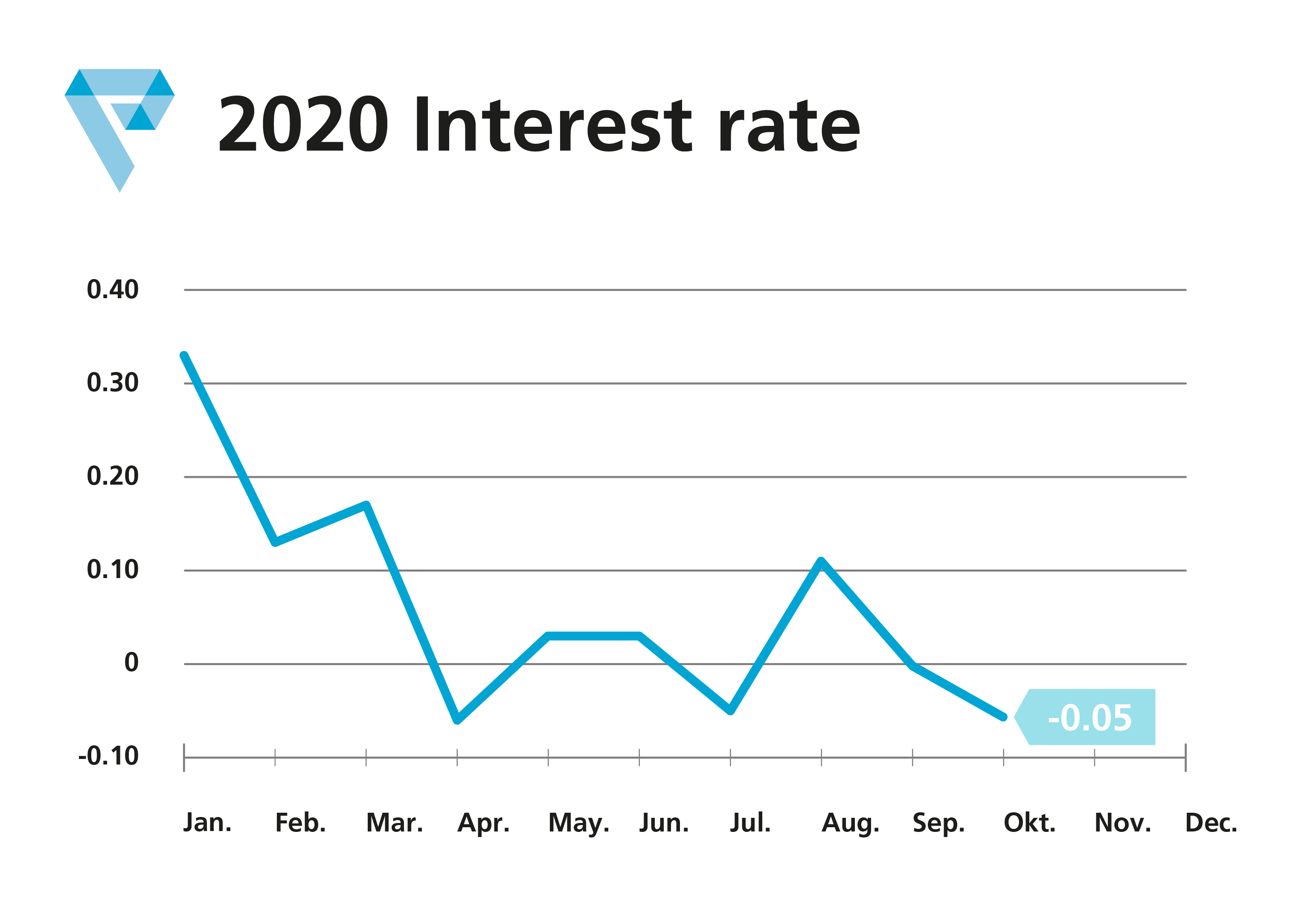

Interest rates have also fluctuated as a result of the unrest, showing steep declines as well as sharp increases. Rates are currently lower than at the beginning of 2020 and the preceding period, but well above the lowest point in March.

Funding ratio

At year-end 2019 the pension fund's funding ratio was above 100%. After the outbreak of the coronavirus, the funding ratio dropped quickly, followed by partial recovery. Partly as a result of major interventions by the central banks, interest rates are currently lower than at year-end 2019. As a result, the pension fund’s funding ratio is lower than at year-end 2019. Click here to read more about the pension fund’s indexation decision, which was based on the situation as at 30 September 2020.

Acceptable risks

ING CDC Pensioenfonds compiles well balanced portfolios with good prospects for return at acceptable risk levels. This course was maintained in recent months amid the outbreak and spread of the coronavirus pandemic. It’s the only way the pension fund can meet its future pension commitments.

More information

Click here to read more about the policies your pension fund applies to ensure its portfolios are well balanced, with good prospects for return at acceptable risk levels. More information on the funding ratio and return on investments is available here.