Select your age

Summer 2018

Combining options in the Pension Planner

The Pension Planner helps you take control over your pension. It will give you answers to questions like: How much will my pension plan pay out when I’m retired? Will that be enough? What action can I take? And it lets you make various calculations by combining pension options to produce the result that works best for you. For example, you could opt for higher pension benefits in the first years of your retirement, so you can bridge the gap until your Dutch state pension (AOW) starts paying out. Would you like to find out how the Pension Planner works?

How much money will you need to cover your cost of living as well as pay for enjoyable things once you’re retired? What options do you have to live in retirement as comfortably as you’d like to? Your first visit to the Pension Planner will answer these questions within 25 minutes.

Designed to fit your phase of life

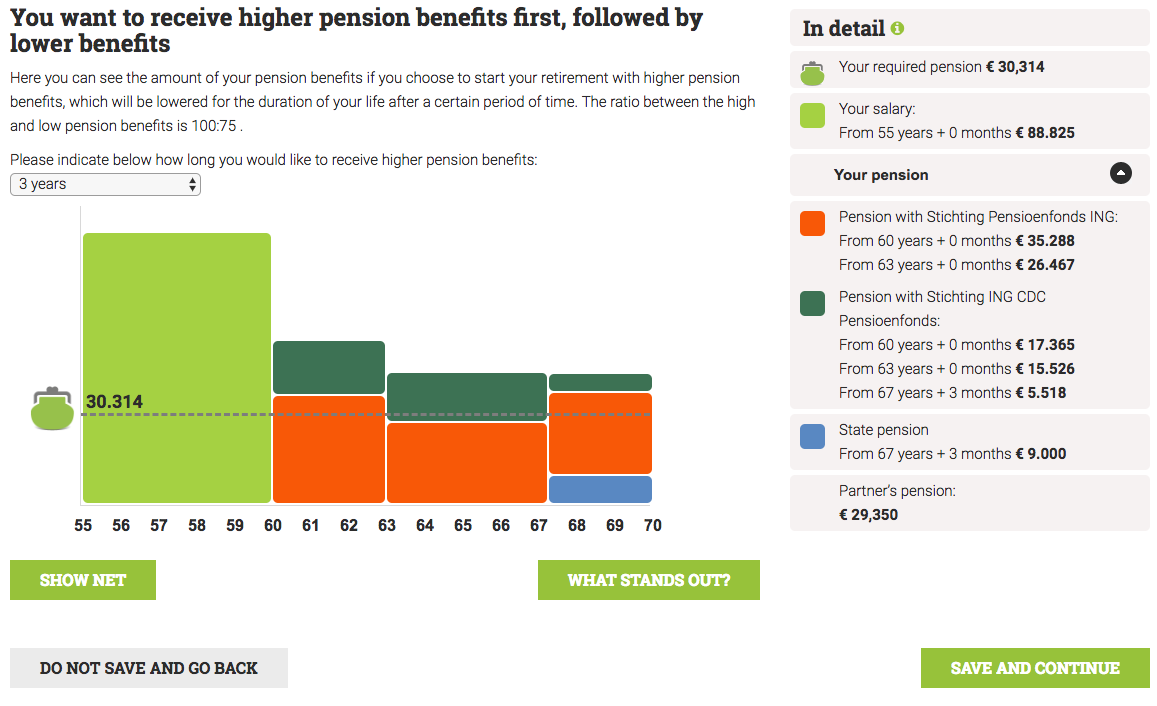

You can design your pension to fit in with whatever phase of life you’re in. Options include early retirement, converting partner pension into additional pension income and variable pension benefits. You could also use some of your pension to bridge the gap until your Dutch state pension (AOW) starts paying out. The Pension Planner instantly calculates the financial implications of your choices (before and after tax). Below, you’ll see some examples of combinations in pre-tax annual amounts. The corresponding diagrams show you which parts will be paid out by ING CDC Pensioenfonds, Pensioenfonds ING and the Dutch state (AOW pension).

Scenario 1: Higher/lower pension benefits ending during your AOW gap

Say you work at ING until you turn 60 and then have your pension start paying out. Your AOW retirement age is 67 years and 3 months. You’d like to have more financial scope in the first years and you combine the following options:

- Pension benefits start at 60 years.

- Higher pension benefits from 60 until 63 years, followed by lower benefits in the years after.

- Bridge the AOW gap between 60 and 67 years + 3 months, followed by lower pension benefits in the years after.

This is how it works out for you:

Scenario 2: Higher/lower pension benefits ending after your AOW gap

Say you work at ING until you turn 65 and then have your pension start paying out. Your AOW retirement age is 67 years and 3 months. You’d like to have more financial scope in the first years and you combine the following options:

- Pension benefits start at 65 years.

- Bridge the AOW gap between 65 and 67 years + 3 months, followed by lower pension benefits in the years after.

- Higher pension benefits from 65 until 70 years, followed by lower benefits in the years after.

This is how it works out for you:

Scenario 3: Lower/higher pension benefits ending during your AOW gap

Say you work at ING until you turn 60 and then have your pension start paying out. Your AOW retirement age is 67 years and 3 months. You’d like to have more financial scope after you turn 63, so you combine the following options:

- Pension benefits start at 60 years.

- Bridge the AOW gap between 60 and 67 years + 3 months, followed by lower pension benefits in the years after.

- Lower pension benefits from 60 until 63 years, followed by higher benefits in the years after.

This is how it works out for you:

Scenario 4: Lower/higher pension benefits ending after your AOW gap

Say you work at ING until you turn 65 (gross income 47,933 euros) and then have your pension start paying out. Your AOW retirement age is 67 years and 3 months. You’d like to bridge the gap until your AOW starts paying out and you want more financial scope after you turn 70. These are your options:

- Pension benefits start at 65 years.

- Bridge the AOW gap between 65 and 67 years + 3 months.

- Lower pension benefits from 65 until 70, followed by higher benefits in the years after.

This is how it works out for you:

Make well-informed pension decisions

Use the Pension Planner to calculate how various pension options would work out in your situation. The Planner does not require you to confirm any choice. If you decide to select an option, you must report your choice to the Pension Desk no later than four months before your retirement date. Make well-informed pension decisions. Once you've reported your decision to us, it’s irreversible. So before you make any decision, be sure to check when your Dutch state pension (AOW) starts paying out and visit the website for more information.