Select your age

Summer 2018

So what’s the truth about your pension?

Be honest… Do you believe you’d get better results if you could invest your pension contribution by yourself? And do you think you’re actually paying for the pensions of current pensioners? And that you have no influence on your own pension situation? These and other myths will be discussed in this article.

Pension is an important employment condition, no matter what age you are. After all, your pension plan not only ensures you’ll have income when you retire, it also covers occupational disability insurance and income for your surviving dependants should you pass away. You and your employer pay contributions into your pension fund every month, which in fact makes your pension a deferred part of your salary. So it's time you started reviewing the status of your pension!

Myth 1: My future pension benefits will be lower than the pension contributions paid over all those years.

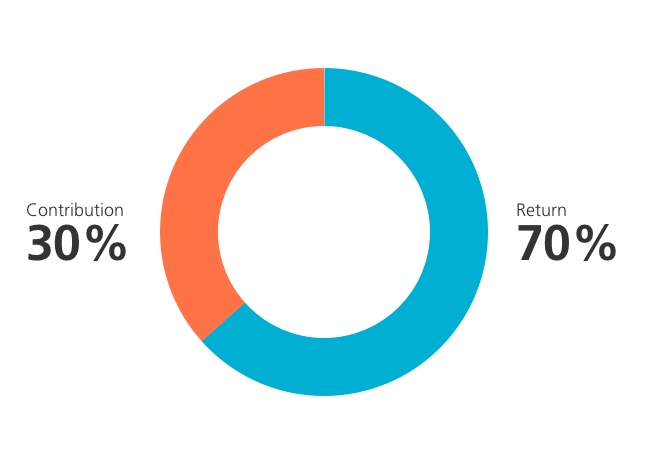

Fact: you will be paid out a lot more than what you paid in by way of contributions (30%). Most of your pension benefits, some 70%, will be paid from return realised on the pension fund’s investments (source: Dutch Pension Federation). In other words, when you retire you’ll receive a lot more pension than the cumulative amount of all the pension contributions.

Would you like to know the current status of your pension? Use your DigiD to login to the Pension Planner, where you can check:

- The annual pension benefits you’ve currently built up through ING's pension plan and any preceding employers’ pension plans you’ve taken part in.

- The pension benefits you could ultimately receive if you continued to work at ING until your retirement date.

- What action you could take if your pension isn’t as much as you'd like it to be.

Myth 2: Putting your pension savings into bank deposits would be more profitable than investing it.

To ensure that there will be enough capital to pay out your future pension benefits plus indexation, pension funds invest the pension contributions. Putting that money into bank deposits would not be profitable enough. If pension funds had put all that money into bank deposits over the past thirty years, current pension benefits would be much lower.

You can check how your pension fund's investments are performing in the pension fund’s quarterly reports.

Myth 3: Pension funds take too much risk when investing.

Investing pension savings is essential to ensure future pension benefits will be adequate and will have kept up with inflation. And investing without any risk is simply impossible. ING CDC Pensioenfonds adheres to a prudent investment policy which is based on an optimal balance between return, risk and responsible investments.

If you’d like to stay up to date on your pension fund’s investments, you can check your pension fund's quarterly financial performance on the website. Click here for the most recent version.

Myth 4: I am paying for current pensioners' pension benefits (pay-as-you-go system).

Only Dutch state pension (AOW) is based on a pay-as-you-go system, under which current taxpayers contribute to the pensions of current pensioners. As the administrator of ING’s CDC pension plan, ING CDC Pensioenfonds provides you with additional pension on top of your state pension (AOW).

The CDC pension plan is the same for all of ING's employees, although everyone's personal situation may be different. Solidarity and collectivism are fundamental values to the CDC pension plan. This means that positive as well as negative results are shared by all employees.

Every month, your employer charges you a small portion of the total pension contribution by way of a deduction from your salary. This has been agreed in the Collective Labour Agreement. For 2018, your part of the contribution amounts to 6% while your employer contributes 27.85%. This means you spend more than one day a week working for your pension. The contributions are collectively saved into the pension funds.

If you’d like to know what the social partners (the employer and the trade unions) agreed in the Collective Labour Agreement, visit the pension page on the HR intranet.